ANALYSIS OF FINANCIAL RATIOS FOR THE PURPOSES OF MONITORING PROBLEM LOANS

This paper focuses on the analysis of financial ratios which can be used in case of problem borrowers and/or borrowers whose business shows adverse trends potentially jeopardising successful loan repayment. These financial ratios may be helpful in assessing risks and prompt decision-making regarding further steps to be taken concerning borrowers.

Additional financial ratios and indicators are especially useful when a financial institution’s portfolio at risk is growing and economic losses of clients become noticeable.

Financial ratios are an important tool in analysing business clients (for more information on financial ratios please see an e-lesson on the RSBP Knowledge sharing and exchange platform www.rsbp-ca.org).

Apart from the basic ratios used for the analysis, in case of problem loans, we can recommend the following additional indicators:

- Break-even point

- Liquidity

- Inventory safety margin (financial stability ratio given inventory)

- Total equity-to-debt ratio (ratio of equity to total credit exposure).

Break-even point (BEP) in money terms

The BEP shows the minimum sales volume in money terms that allows a company to break even, i.e. to operate without profit or loss (at a zero profit). There are several formulae used for BEP calculation. The most common formula used in analysis of micro and small enterprises (MSEs) is the following:

FC – total fixed or quasi-fixed costs (actual costs of the reporting period)

FE – family expenses

I – total interest accrued (on all business loans)

S –sales revenue

VC –variable costs

The BEP is used for the analysis of sales trends and shows the volume of sales a client should maintain in order to match his/her liabilities (excluding loan principal instalments) without affecting owners’ equity. The BEP is useful when considering debt restructuring.

Since business and family cash flows are difficult to separate and a business is often the main or even the only source of funding for a family budget, it is recommended to include family expenses in the BEP calculation for the MSE segment.

Please be careful in your calculations as the BEP is not stable and may change depending on the conditions of business operations. For example, costs will usually inevitably increase as a result of production expansion or the opening of new points of sale: additional premises will lead to higher rent expenses, and hiring additional staff results in a rise in payroll costs, etc. Business growth will result in a higher break-even point.

If business conditions remain unchanged but the break-even point increases, this can be a signal of a company’s deteriorating financial condition.

The importance of the BEP in analyzing a business can also be seen when the BEP is compared to other financial indicators. For example, when analysing sales trends, the BEP can be used to calculate profitability for respective periods.

Liquidity

Deteriorating business conditions primarily affect liquidity levels of a company. In order to maintain their sales volumes, companies may increase the share of sales at deferred payment conditions, thus increasing the share of accounts receivable. The result: there is a profit, but there is no cash to repay debts.

Available liquidity as of the date of the balance sheet allows to draw conclusions about a company’s ability to make timely loan payments. Available liquidity can be determined by drawing up a Cash Flow statement. There is also another method of determining liquidity without preparing a Cash Flow statement:

L – liquidity

OCB – opening cash balance

TCF – total cash inflow for the period

OCF – other cash inflows

P – purchases made and paid within the analysed period

TFC – total fixed costs

TI – total instalment on all loans, incl. consumer loans

FE – family expenses

This indicator shows the immediate liquidity of a business. It can also be used for liquidity projections for the upcoming months, which is especially useful for businesses with pronounced seasonality.

Inventory safety margin

It is not uncommon for a business to maintain acceptable liquidity levels and meet existing liabilities although actual financial results may be negative. In order to meet its liabilities, a business could use proceeds from the sale of fixed or working assets (more commonly, inventory). As a result of declining investments in inventory, the inventory volume decreases, thus affecting not only the financial result but also the very existence of the business in itself. An ill-considered inventory reduction can lead to a shut-down of the business and, thus, jeopardize loan repayment.

For the economic assessment of such business situations, we recommend calculating the inventory safety margin. This ratio shows the number of months that a client can cover liquidity needs using existing inventory, provided all other business conditions remain unchanged.

ISM – inventory safety margin

NP – net profit of the period (month)

TI – total instalment for all business loans

This indicator should be compared to the number of months remaining to loan maturity. If the number of months remaining to loan maturity is more than the ISM, this signals the need to take a management decision regarding loan roll-over, early loan repayment with proceeds from the sale of company assets, etc.

However, it should be borne in mind that in most cases a decline in inventory will lead to a decline in sales volume and, accordingly, to a lower financial result as well as a lower inventory safety margin.

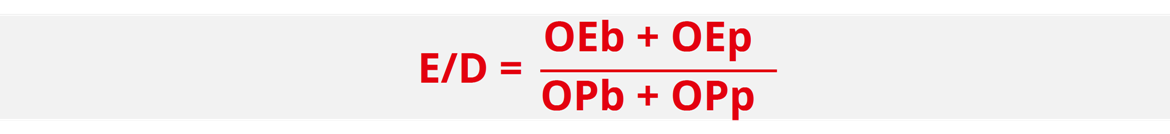

Equity-to-debt ratio (total equity to the aggregate outstanding principal)

Businesses tend to use several sources of finance and, especially if business is going down, businesses will try to use all available sources of credit with a view of delaying payments or building up inventory in the hope of generating more sales, etc. Nowadays, it is also not uncommon for borrowers to have several outstanding loan products, and the small business segment is no exception.

The equity-to-debt ratio helps loan officers to assess the degree of client-reliance on external financing and shows the ratio of the owners’ total equity (in the business and beyond the business) to the aggregate outstanding loan principal, including consumer loans.

E/D – owners’ equity to debts

OEb – owner’s equity in the business,

OEp – owner’s equity beyond the business (private),

OPb – outstanding principal of all business loans,

OPp – outstanding principal of all private loans

For micro businesses and the lower-end segment of small businesses the recommended minimum for this ratio is 1. It is important to remember that - especially for micro and very small businesses - the amount of debts should not exceed the owner’s/owners’ own stake in the business. If the amount of all current loans is larger than the borrower’s total equity, the risk for a financial institution is very high.

Needed data

For the calculation of the above ratios, at least the following data needs to be obtained from the borrower:

- the amount of sales in the last month (immediate and with deferred payment);

- changes in pricing policy (trade mark-up, profitability of production)

- the amount of cash inflow in the last month;

- the amount of purchases in the last month (immediate and with deferred payment);

- fixed or quasi-fixed costs (payroll, taxes, rent, transport costs, etc.);

- family expenses (including changes in income of other family members);

- the sum of all current instalments (on business and consumer loans) from all financial institutions, subject to possible changes[1];

- liquidity;

- available inventories;

- fixed assets;

- accounts receivable and payable with respective repayment deadlines;

- outstanding loans from other financial institutions[2]

[1] Even better is to include all other obligations, if available, including from informal sources, but it is not always possible to get this information; furthermore, repayments may be more negotiable than in formal finance

[2] See above

Case study:

The client is a retail trader in silver jewellery. In June, the client received a working capital loan in the amount of 500,000 for 16 months (with a monthly loan instalment of 35,000). In recent months, the client has violated the loan repayment schedule. In the course of monitoring (in January of the year following the reporting year), the loan officer gathered the following information:

|

The client is a retail trader in silver jewellery. In June, the client received a working capital loan in the amount of 500,000 for 16 months (with a monthly loan instalment of 35,000). In recent months, the client has violated the loan repayment schedule. In the course of monitoring (in January of the year following the reporting year), the loan officer gathered the following information: |

|

|

Sales of the past few months |

October – 400,000 November – 250,000 December – 325,000 |

|

Variable costs |

October – 307,692 November – 192,308 December – 250,000 |

|

Fixed and quasi-fixed costs, including all interest accrued |

40,000 |

|

Family expenses (including repayment of a consumer loan) |

20,000 |

|

Cash in hand |

0, since all accumulated cash was used to repay loan instalments. |

|

Opening cash balance at the beginning of the previous period |

0, since all accumulated cash was used to repay a loan instalment (in December) |

|

Inventories |

400,000 |

|

Inventories as of the date of the loan disbursement |

500,000 |

|

Outstanding principal balance of a business loan |

280,000 |

|

Outstanding principal balance of a consumer loan used for the purchase of real estate |

1,000,000 |

|

Owner’s equity in the business |

500,000 |

|

Owner's equity beyond the business |

1,500,000 |

|

Cost of merchandise inventories purchased last month |

230,000 |

For the calculation of the BEP, we use the average amount of sales for the past three months – 325,000 ((400,000+250,000+325,000)/3) and the average variable costs – 250,000 ((307,692+192,308+250,000)/3).

The resulting BEP will look as follows:

So, for the company to breakeven, its minimum sales volume should be 260,000. If we compare this to the client’s actual sales, we see that the November result was negative.

Failure to comply with the repayment schedule indicates liquidity problems at the client’s business.

The estimated liquidity as calculated will be:

Calculated liquidity confirms that the client provided correct data.

The average monthly net profit of the last three months is 15,000 (NP=325,000–250,000-40,000-20,000). This profit amount cannot cover the current loan instalment. The client must have been repaying the loan at the expense of inventory, which is gradually decreasing. This assumption is confirmed by the decreasing inventory balances.

Inventory safety margin:

The entrepreneur will be able to maintain the liquidity of the business at the expense of the current volume of inventory for 20 months, provided that the business situation does not change. Given that there are only 10 months remaining to loan maturity, the entrepreneur should be able to manage this credit exposure and the business should be able to continue.

The equity-to-debt ratio calculation:

Total business and private equity is 1.56 times higher than total liabilities. This ratio is within the acceptable norm (i.e. >1).

Conclusion:

The client has been in breach of the repayment schedule due to the overall deterioration of the financial and economic condition of the business, which is confirmed by monitoring. The calculated ratio values helped to determine the degree of this deterioration, but showed that the client should be able to manage the current loan burden and keep her business running. However, the client has certain liquidity problems, so we can recommend reviewing the client’s payment schedule, more specifically, splitting the loan instalment into two (or three) smaller instalments. This will help the client to shorten the period of liquidity accumulation.

Another possible option is to find a more suitable date for instalment repayment in consultation with the client and by moving the date to a date where there are no other payments. In addition, regular monitoring should be done to prevent a possible default in case of deteriorating business performance.

The financial ratios described here, along with other financial tools used in analysing business, allow for identification of problems and difficulties at client businesses and, therefore, for prompt reaction to any changes in the business situation and for taking appropriate action to avoid default and resolve problematic debts.