For high-quality lending decisions, financial institutions carry out an all-round analysis of a client's business. They examine formal reporting and managerial data, business scheme and model, cross-check and analyze obtained information. At the same time, you can see that specialists involved in data collection and processing of information, and decision-making on loans cannot always quickly focus on the main aspects and specifics of a particular field of activity. Understanding the specifics of each individual field/line of business allows you to conduct the first client meeting more effectively and competently, in the course of which you can determine the potential client’s needs taking into account the type of business, assess the prospects of cooperation with the client, and prepare him/her for the more detailed business analysis, and, more importantly, to conduct a meaningful and high-quality business analysis, which involves:

Asking the business owner and other persons involved in the business competent, correct and pertinent questions, processing obtained information, cross-checking it, analyzing it allows you to make high-quality loan decisions and decisions on further cooperation with a potential client.

This article focuses on the analysis approach used for the following types of business activity:

Before delving into the topic, we would like to note that during the first stage of analysis it is important to understand what kind of business the client is engaged in, study the business scheme and model. This helps you to define your course of action when analyzing any field of activity. In addition, clients from each sector will usually also have individual specifics. Therefore, invite the client to talk about how the business is organized, how information is stored, how calculations are done before examining available formal and managerial documentation.. This will help make the analysis more sensitive and focused.

In this article, we will look at the main aspects and nuances to focus on when analyzing businesses of the above-named industries.

Let us start with trade.

| TRADE |

Retail and wholesale trading companies purchase goods from other companies (including manufacturers) for then reselling them. Examples of trading activities may include trade in groceries, household goods, clothes, footwear, stationery or flowers etc. The points of sale can be physical outlets and online stores (virtual). The goal of any trading business is to resell goods for a price higher than the purchase price. In other words, the sales price should be high enough to cover the purchase price, operating costs, and leave enough profit for the business ‘to make sense’.. Thus, in a general sense, earnings in trade are formed as the difference between sales and purchase prices, and the business itself focuses on buy & sell transactions.

Retail and wholesale trading companies purchase goods from other companies (including manufacturers) for then reselling them. Examples of trading activities may include trade in groceries, household goods, clothes, footwear, stationery or flowers etc. The points of sale can be physical outlets and online stores (virtual). The goal of any trading business is to resell goods for a price higher than the purchase price. In other words, the sales price should be high enough to cover the purchase price, operating costs, and leave enough profit for the business ‘to make sense’.. Thus, in a general sense, earnings in trade are formed as the difference between sales and purchase prices, and the business itself focuses on buy & sell transactions.

The analysis will focus on issues related to thepurchase and sale of goods, as well as on operating costs. It is important to analyze the following information:

- whether the trading terms meet current client requirements and market trends;

- seasonality;

- marketing policy and promotion of goods on the market;

- balance sheet indicators of a trading enterprise, including inventory turnover rates;

- profitability trends and change-factors;

- sale/purchase schemes; contractual relations with suppliers and buyers: study contracts, the terms of delivery of goods, analyze the customer base, as well as the terms of sale of goods, find out if payment deferrals are possible etc.

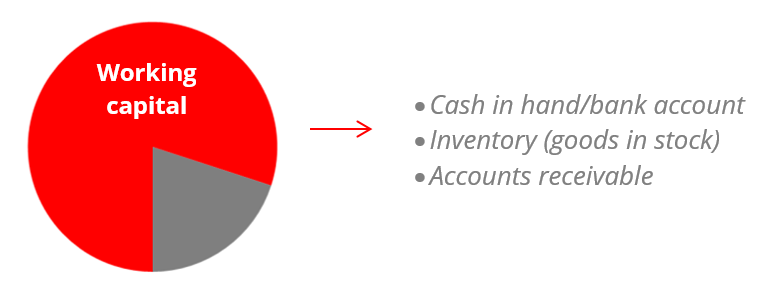

The balance sheet profile of a trading company is usually characterized by a high share of current assets: cash, inventory, and possibly accounts receivable (especially relevant in the case of wholesale) (see Chart 1). To conduct continuous trading activities, businesses need cash and cash equivalents. However, the structure of current assets may differ from company to company, depending on the specifics of a particular client (business). Retail chains normally sell goods without payment deferrals (retail customers usually pay for goods immediately upon purchase), therefore the share of accounts receivable from customers in their asset structure will be low. In wholesale trade, the situation can be different: the share of accounts receivable from customers for goods can be high. Many wholesalers offer deferred settlement terms as part of their terms and conditions of cooperation.

Chart 1. The share of current assets (working capital) in the asset structure

However, if, for example, a business has invested in the purchase of premises, then the structure will be different with a high share of fixed assets and/or their predominance over working capital.

Inventory is the most important asset for a trading company. During the analysis, it is worth paying special attention to the structure of inventories and turnover rate which measures how fast goods in stock turn over (sell) on average. With regard to the structure of goods, a financier should determine which goods are liquid and which goods may be subject to write-off or will be sold at a large discount; which of the goods belong to the business, and whether there are goods on credit or on “sell or return” terms, what are the entrepreneur’s liabilities on purchased goods well as what the mark-ups on different groups of goods sold are and what the weighted average mark-up is at each point of sales.

It is important to assess whether the volume of current inventories is compatible with the volume required. In this way, you can identify the risk of "overstocking" or "understocking" goods.

Compare the client’s inventory turnover rates with those of similar businesses and average industry indicators. If your client’s inventory turnover rate is higher or lower if compared to similar businesses and industry-/region-average indicators, then this is a reason for a more careful examination of such deviations. For example, if the average inventory turnover rate for similar trading businesses in a given region is 5 days, then a ratio of 8 days for your client may be a reason for more detailed investigation of reasons. Of course, for different commodity groups, inventory turnover rates will differ: perishable goods should turn over faster than clothes or equipment.

It makes sense to discuss any discrepancies with the client. A very large, non-typical volume of goods in stock may have its objective explanation. For example, a client changed his/her business line and purchased a new group of goods, which may be dictated by demand. In order to make the offer more attractive and meet customer demand, the client needs to offer a certain assortment. In this case, at a particular point in time, the client may have an unusually large volume of inventory if compared to previous periods or similar clients. But there may be another situation where a large volume of inventory can be attributed to lower seasonal sales than expected so that our potential client may be forced to sell these at a discount. It may also turn out that the good is not in demand at all. Generally, a large amount of unclaimed inventory may indicate that the potential client has a poor idea of the level of supply and demand in the market. There may also be other factors: for example, the late arrival of a certain batch of goods delivered much later than expected due to closed borders etc.

But it is not indicated to label high or low inventory turnover rates as good or bad. It is important to look at the actual situation of client and evaluate it on a case-by-case basis.

On the balance sheet of a trading company, we can see short-term liabilities comparable to its working capital (see Chart 2). If there is a bias then it makes sense to examine the situation more closely, e.g. if inventories are financed with "long money" or there are "short-term liabilities" that are not comparable to working capital assets.

Chart 2. The purpose of short-term loans is to finance working capital

It is also important to analyze the quality of accounts receivable from customers. If an analyst understands that the debt of a customer is unrecoverable, then this debt should not be included it in the balance sheet as accounts receivable. This may also affect future inventory purchases.

Trading businesses are subject to demand fluctuations: demand can be high or low, depending on the commodity group and season. There are many options to measure profitability of sales (ROS, i.e. return on sales reflects the share of profit in total sales). For example, for a retail store, you can use the classic approach: the ratio of net profit to total sales revenue. The return on sales ratio shows you how much profit is earned per one monetary unit of revenue. This indicator must be higher than zero. Sometimes, in order to attract more customers or “push out a competitor,” owners (managers) decide to reduce trade mark-ups, which can ultimately reduce their profit margin. It is worth understanding these nuances and being able to assess the profitability of sales as this can be indicative of pricing policy issues.

As with other types of business, it is also important to assess quality indicators of trading companies, such as quality of management, staff turnover rates, marketing, quality of services, quality of the documentary flow regarding various authorities (tax authorities, landlords, etc.). Let's take personnel as example: it is common knowledge that one seller is able to sell a certain good, while another seller cannot. Sometimes there is a direct relationship between the level of sales and staff turnover. And the staff turnover may increase or decrease sales volumes at an outlet. The marketing policy also affects the level of sales in a market, while poor quality documentary operations can undermine the smooth running of any business.

While operating conditions of different trading companies may vary significantly, there are a few common factors that indicate a ‘good’ state of affairs and make trading businesses more attractive to financiers:

- favorable location;

- modern approach to customer service;

- high demand for goods;

- ever-growing customer base and the presence of regular customers;

- well-established and stable cooperation with suppliers;

- stable liquidity;

- sufficient and high-quality inventory and a sufficient range of goods;

- permanent staff and low staff turnover;

- positive profitability; retained earnings sufficient for business development.

| PRODUCTION |

Manufacturing is a field of activity where raw materials are processed and converted into ready-for-sale goods (either semi-finished and/or finished goods). For this field of activity, technologies, equipment, specialists, distribution channels, etc. are important. Production can involve the use of high-tech equipment and manual labor.

The starting point of the analysis of a manufacturing business is the study of what is produced, the business scheme and the production cycle. It is recommended to get answers to the following questions:

- What does the business produce?

- Is there demand for the product or not?

- Is the technology used up to date?

- What is the quality and price of the goods produced?

- Is there competition? How competitive is our client in terms of product quality, price, etc.?

- How is the production process organized?

- What equipment is involved in the production cycle?

- What is the maximum and actual equipment capacity? What equipment is involved in the production cycle? Is it used at its maximum capacity or only partially?

- Is there a seasonal dependence of production?

- What is the duration of the production cycle?

- What are the volumes of production and the volumes of sales?

- Other

Depending on the scale of the enterprise and the production process, the approaches to collecting and processing information will also differ. If it is a small production business (for example, one production line for chips), then the business process will be quite simple and easy to analyze. But if an enterprise produces many different products or there is one production line that produces different types of products, then analyzing the production cycle will be quite laborious. In this case, it is recommended to divide the core production process and auxiliary production and analyze processes separately by area of production (by production line, by workshop, etc.).

In any case, it is important to assess production volumes and distribution of products. These are two interdependent indicators. For a business to work effectively and develop, it is important to produce such goods and in such amounts that can be realistically sold. If a manufacturer produces more products or fewer products than the business can sell, this is usually bad. In the first case, this will mean accumulation of unsold products in warehouses and lost income. In the second case (when a manufacturer produces less than it can sell), it may indicate inefficient organization of production, lost opportunities and/or problems in production as well as the risk of losing customers.

Estimate the demand for products and compare the volumes of goods produced and sold. After all, the volume of production depends on the demand for products in the market. These are two inter-related indicators. Analyze trends in the volumes of production and sales, look at the seasonality and consider the ups and downs in the production of a particular product. It should be kept in mind that manufactured products that could not be sold within reasonable time limits will usually be written off in the future. Analysts often make the mistake of using production volumes to assess the volume of sales.

One serious aspect to be considered is the fulfillment of contractual obligations by the client under supply contracts. Therefore, it is important to study the client’s supply contracts with customers. Failure to fulfill delivery plans under contracts may result in a decrease in revenue, profits and penalties envisaged by supply contracts. Let us take flour production as an example: A company produces 1,000 tons of flour per month on average. However, according to supply contracts, over the past 6 months, it has been selling only 500-600 tons of flour per month. This means that the rest of the manufactured flour has been going on stock. How long can flour be stored in a warehouse and will it be sold in the future at the same price …? This is a cause for careful analysis.

Production implies that an enterprise must have working capital needed for manufacturing goods. When analyzing production enterprises, it is important to pay attention to the efficiency of the use of current assets. It is recommended to pay special attention to the stock of raw materials available for the production cycle, evaluate and compare the following information: storage periods of raw materials and their turnover, purchase amounts and the sufficiency of raw materials as per calculation to ensure a continuous production process. It may turn out that material is being stocked that will not be used (overstocking). It is worth examining this situation in more detail and finding out why this happened.

In the process of the analysis, we pay attention to the condition of equipment, its service life, the source of financing its procurement, availability of ownership and other documents (certificates etc.) and whether such equipment is liquid today (easy to sell). We should understand that production activities are associated with high production risks. Firstly, if equipment is used without required documents, there may be a risk of fines and penalties imposed by respective supervisory authorities (due to violations of fire safety, labor protection requirements etc.), and you will not be able to take such equipment as collateral if the client does not have ownership documents for it. In addition, equipment that is used without proper documentation and/or without proper care can have a negative impact on the environment and personnel.

Fixed assets are usually characterized by a rather long service life, but you should keep in mind that they are subject to regular maintenance and overhaul, which implies costs.

It should be noted that the organization of production usually requires large investments, therefore we need to look very carefully at the sources of funding, i.e. own investments or borrowed funds.

Remember that production activities typically require more permits and licenses than trade and services. If any permits/licenses are missing, this implies increased risk. Unlike service and trading companies, manufacturing companies are less flexible in the event of emergencies and force majeure situations. Therefore, it is best to be skeptical and assume that such events can occur in any manufacturing process. The business cycle is usually longer and, therefore, liquidity may vary at certain points in time. Manufacturing relies on qualified personnel who operate and maintain production facilities.

In a trading business, the issue of pricing and cost of goods sold is quite clear. As opposed to this, in a manufacturing business, calculation and accounting of production costs depends on the accounting methodology adopted by the company for cost accounting and for calculation of the cost of production.

It is important to understand the manufacturer's own calculations. This can save you a lot of time: once you understand how to calculate certain positions, you also understand what and how you should calculate. You study how production costs are calculated by the business and what costs are included in the cost calculation per unit of production. This calculation may include the cost of raw materials and supplies, wages and other remuneration of personnel directly involved in production, payroll tax deductions of these workers, utility costs and the cost of heat and energy resources consumed in the production process, the cost of waste/losses and other production costs etc.

We have listed only the main features of the analysis of a production enterprise and what to focus on when collecting information about production, but even from this, it is clear that the analysis itself and the approach to it can be quite difficult. Often, it may take up to several days for a loan officer to collect and process all necessary information, and involvement of different specialists on the side of the manufacturing company (specialists from the production hall, accountants, managers etc.). Therefore, loan officers must have a high level of training.

| SERVICES |

Cafes, restaurants, hairdressers, beauty salons, car washes, private kindergartens, fitness clubs, foreign language schools, legal services etc. are examples of service providers. This spere of business typically has the common advantages such as minimal start-up investments and high profitability levels. Of course, there are service areas where start-up investments caan be significant, for example, IT or car services.

Cafes, restaurants, hairdressers, beauty salons, car washes, private kindergartens, fitness clubs, foreign language schools, legal services etc. are examples of service providers. This spere of business typically has the common advantages such as minimal start-up investments and high profitability levels. Of course, there are service areas where start-up investments caan be significant, for example, IT or car services.

Companies providing services have individual specific features which may differ significantly depending on business specifics. These will affect profitability and balance sheet features, and, ultimately, the focus of the analysis. For example, in the case of taxi services, the analysis will usually show a large share of fixed assets on the balance sheet total, while the share of fixed assets is likely to be low in the case of legal services,, and, therefore, the focus of the analysis in the first and second cases will be different. From the table below, you can see that for all types of services, the analysis will focus on the availability of intellectual/skills resources (i.e. competent specialists), working scheme and the number of orders, while the need to lookdeeper into working capital and fixed assets will depend on the specific features of a given business.

The length of the business cycle in the services sector may also vary significantly: from several minutes/hours (hairdressing salons, photo studios, cinemas, other consumer service providers) to several months (companies that work on large individual orders).

Consequently, the financial ratios of service providers will vary significantly, especially those based on balance sheet indicators, and deviations from standard normative values can also be significant: for example, working capital turnover rate, the ratio of fixed assets, the debt-to-equity ratio etc.

Table 1. Comparing different types of service providers

|

Activities |

Specialists |

Number of orders |

Operating scheme |

Current assets |

Fixed assets |

|

Car service |

|

|

|

|

|

|

Medical services |

|

|

|

|

|

|

Passenger and cargo transportation |

|

|

|

|

|

|

Rental services (real estate, equipment, vehicles) |

|

|

|

|

|

|

Consulting (legal, financial) |

|

|

|

|

|

|

Information Technology |

|

|

|

|

|

|

Cleaning services |

|

|

|

|

|

|

Tourist services |

|

|

|

|

|

As a rule, the share of current and fixed assets in the structure of the balance sheet will be relatively low in most cases. Inventories in the service sector either do not exist at all (for non-production services), or account for an insignificant share in the structure of current assets (spare parts and components). Accounts receivable may account for the main share of current assets, while for enterprises that work on condition of 100% advance payments by customers, working capital will consist primarily of cash on hand and in bank accounts.

Service sector companies do not usually have long-term liabilities on their balance sheets. But there may be exceptions, as in the case of services involving the operation of fixed assets. Short-term liabilities consist of accounts payable to suppliers and advance payments received from customers and other payables, and, in the case of larger organizations, these are mainly accounts payable to subcontractors. Consequently, service enterprises tend to have small amounts of passive accounts.

In most cases, the cost of services will not be calculated, since no raw materials are involved:

- For services based on the operation of fixed assets, the main expense is associated with their maintenance.

- For knowledge- and information-based services, the main expense is labor costs.

When analyzing service companies and depending on the specifics of each client, the focus should be on the business scheme, the number of standing orders, staffing, quality of services and/or collection of information on the expenditure side.

The specificity of the services sector and its diversity make it rather difficult to analyze the activities of such enterprises. And for this reason, loan officers must learn to focus on common/standard features and the specific features of each individual area of activity of the services sector.

In conclusion, all three areas of business activities - trade, services and production - require a different approach to the analysis. More than that, not only a different approach but also special knowledge. Trade is usually easier to analyze than services and manufacturing. In addition to the nuances that we highlighted in this article, there are other specific features that exist in each separate industry. And the task of all specialists engaged in the analysis of any sphere of business is to be attentive to these features, since an error in calculations can lead to an incorrect result and decision.