In Central Asia a lot of financial institutions are talking about segmentation and client segments. At the same time, there still seems to be some uncertainty regarding what segmentation actually means, why it can be helpful to segment clients and how this can be done in practice.

The aim of this article is to give a short introduction to the topic.

Some definitions

Segmentation refers to the process of grouping individuals – in our case clients/prospective clients - into groups (segments) with common needs, common behavioural patterns and similar reactions to marketing measures. The point is to identify groups that are homogenous as group or segment and respond in a similar manner to certain offers/situations, but are clearly distinguishable from other groups, their needs and their behavioural patterns.

Correspondingly, a client segment refers to a homogenous group of clients with similar needs and similar behavioral patterns.

The purpose of (client-) segmentation

The key reason for market- or client-segmentation rests in the fact that having identified such homogenous groups allows to better design products, sales channels, and marketing approach for respective groups. It also allows for more effective risk management. This allows to reach out to groups more efficiently and effectively.

- Improved focus: fine-tune products specifically to customer needs, target advertising and marketing and focus on most promising (profitable) subsets of clients

- Competitiveness and client retention: knowing who your customers are and what they want opens the door for pursuing them in a targeted manner and for optimizing pricing of products, tailoring products and services to specific subsets and, in this way, also enhance client loyalty

- Potential expansion: knowing your customers and potential customers, their needs and value for you allows you to expand your business with existing clients and to tap into new parts of the market most efficiently and effectively

- Pricing optimization: When you know the financial situation and social status of your clients as well as risk profile and costs on your side, you can optimize pricing to ensure that customers get the most value for their money and you generate maximum possible revenue

If we transfer this into the world of financial service provision, it means that it becomes possible to more adequately define and control risk by designing methodology, processes and procedures for specific parts of the market as well as designing products to fit better to the needs of specific types of clients. This also entails how best to set up operations in terms of organizational structure and personnel requirements, so that effective segmentation allows you to optimize how you do business in principle.

Graph 1: Effective client segmentation as basis for optimizing business

Ideally, client segmentation will result in an optimized strategy, organizational structure, staffing, business processes and product range as the entire approach, product offer, etc. can be tailored to fit the specifics of respective segments. In practice, this usually means trying to make processes, etc. as lean as possible (but as elaborate as necessary) for a respective segment, tailoring product parameters and conditions to meet the needs and possibilities of typical clients of a certain segment and designing your marketing approach and measures in a targeted manner.

Experience teaches, that many enterprises and financial institutions only start looking into segmentation when they start coming under pressure – be it to lower costs due to increasing salaries, continue to be viable in a market with decreasing margins due to increasing competition, etc. One outcome of this is that many businesses, including financial institutions, underestimate the need for collecting, storing and analysing data on clients. In a wide-open and profitable market, it just seems ‘unnecessary’, ‘a waste of time’ on s.th. no-one needs … This comes to haunt businesses and financial institutions later on.

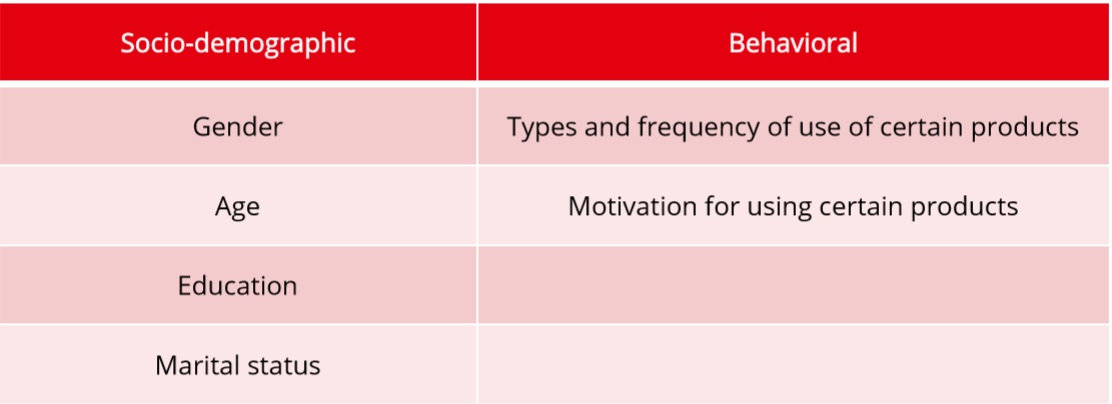

Data used for segmentation

Below we summarize typical data used for segmentation:

- Socio-demographic information – e.g. gender, age, familial and marital status, income, education, social status, and occupation

- Geographical information – this could be country, region, city, town, county or city district a client resides at

- Psychographics – e.g. attitudes, lifestyle

- Behavioral data - e.g. spending and consumption habits, use of products/services or benefits the client is looking for in products/services

Segmentation approach

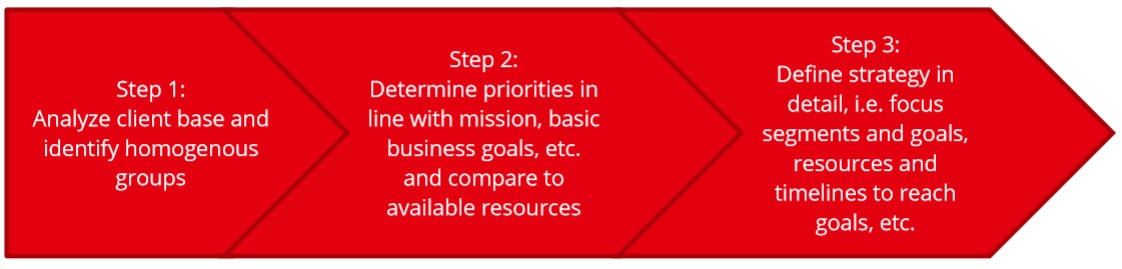

Usually, it takes three basic steps. The basis for meaningfully segmenting an existing or potential client base is information. Only if you have information on who is out there, how they behave, what they need, what they prefer and what they definitely do not need or want, can you start sorting clients into groups.

Based on this, you can then determine where your priorities are, which parts of the market, which clients are of interest to you (generate most value or have the potential for generating value) and what it would take to acquire, serve and retain these clients. You then compare this to your resources, your current set-up, available products, systems, personnel, etc., your strategic goals and plans. This then serves for determining your strategy.

Once you have decided your strategy, you can then go into details on how best to convert this strategy into concrete actions.

Graph 2: Using client segmentation as part of defining strategy

Instruments and data availability

Typical instruments used for analysing markets and client groups are quantitative and qualitative research. This usually takes the form of representative surveys and/or focus groups. Usually, there are professional companies which can assist with this work. In addition, financial institutions can also analyse their own portfolios – if data is available on client profiles, etc. In practice, however, it is exactly this lack of data availability which is a big issue at financial institutions. As indicated above, many financial institutions underestimate the importance of tracking and storing client information, so that, quite frequently, data of a sufficient quality and quantity is not available. Under these circumstances some segmentation is usually still possible but typically less exact, less detailed and, consequently, less useful than would be possible with better data. In any case, all segmentation needs regular review and fine-tuning over time as markets and clients, respectively, client needs and behaviour, may change over time. In any case, it is advisable for financial institutions to track and store client information as completely, correctly and in as much detail as reasonably possible.

Data can be analysed quantitatively and qualitatively. Quantitative approaches typically include looking for clearly distinctive indicators to separate groups from one another and for indicators that help to put certain clients into the same group. In more technical terms, this involves looking for connections between data such as correlations between variables and probabilities that if indicator A applies, indicator B will also apply with a certain probability. Typical examples would be to look for a connection between annual turnover and loan amounts requested or annual turnover and annual profit. Please, note that this in itself says nothing about causality, all it says is that if A changes in a certain way then B is also likely to also change or be different.

Typical indicators used by FIs

When it comes to segmenting business clients, typical indicators used, can include:

Quantitative indicators can usually help at early stages to roughly separate existing client bases or break down a market, but usually just basic quantitative indicators are insufficient to arrive at meaningful segmentation. Take two businesses, for example, with the same annual turnover, the same profit and the same number of employees. However, the one business operates as limited liability company, whereas the other one is set up as sole proprietorship. Clearly, the risk profiles would be different or at least the documents and data you would need from these clients would differ.

Or, to provide another example, take two businesses with the same annual turnover, the same profit and the same number of employees. However, the one business is engaged in housing construction whereas the other is engaged in producing bread. Clearly, the risk profiles differ.

Therefore, usually additional indicators are used to segment clients. In addition to qualitative indicators related directly to the business itself, such as economic sector, ownership structure, etc. there are other factors influencing client behaviour or needs. These can include such indicators as:

In micro lending, for example, generally speaking, data indicates that women tend to be the better borrowers, i.e. more reliable in repaying loans on time than men.

In general, married men tend to be more settled and reliable in fulfilling obligations than bachelors. ‘Older’ people tend to be more responsible than ‘young’ people.

In insurance, for example, women and men often pay differently on car insurance (often there also are different rates for women and men drivers of different ages) as data shows that risk patterns differ depending on gender and age.

So, in short, by analysing your customer base and looking at how different aspects relate to one another you can get a better idea of who your customers are and what they would like to get from working with your institution.

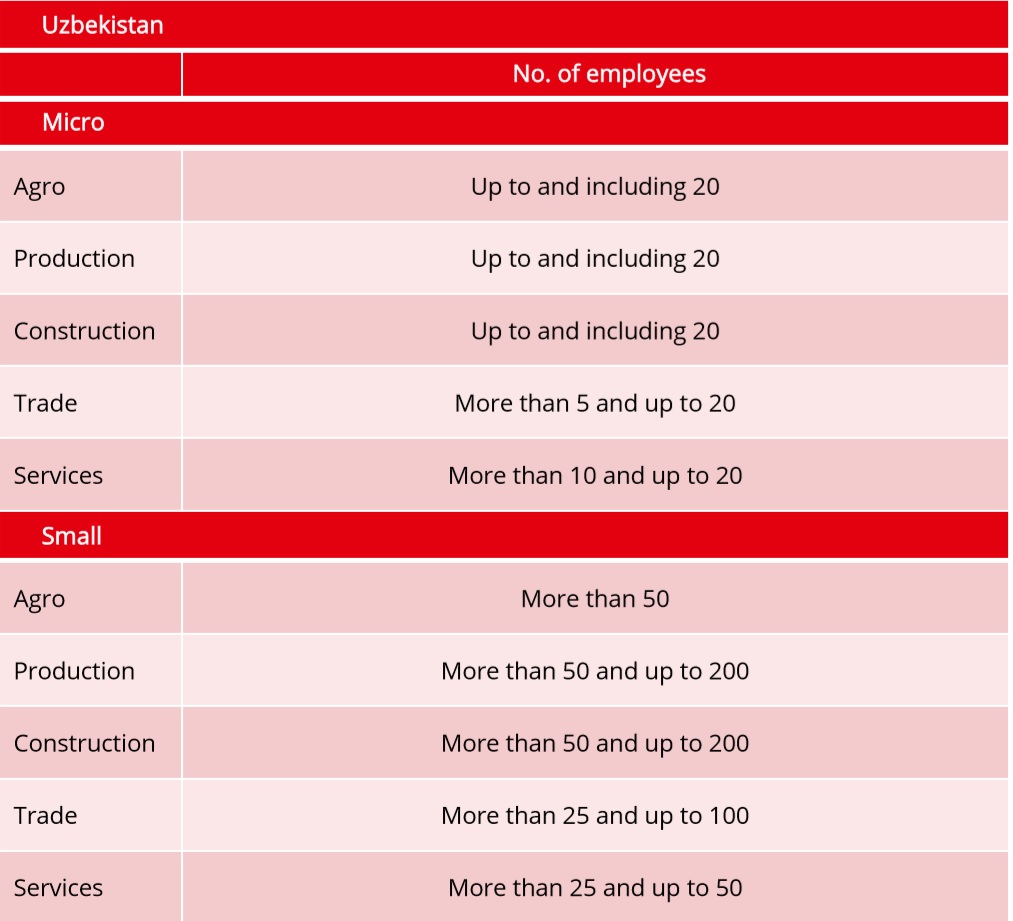

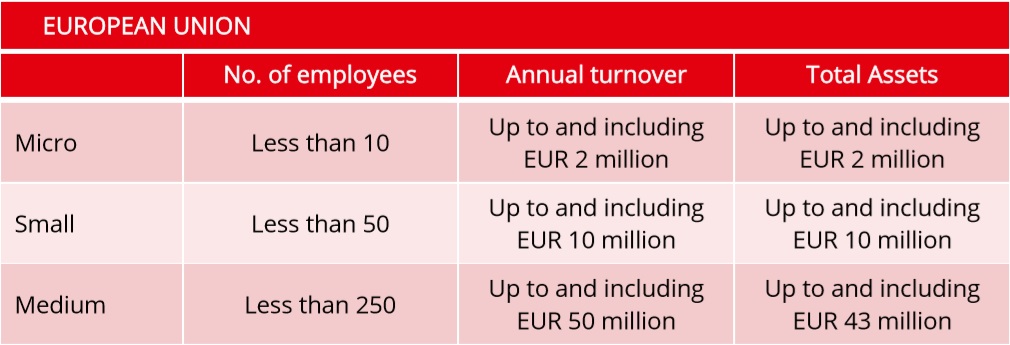

Classification vs. segmentation

Segmentation should not be confused with arbitrary classifications done by governments or other institutions for statistical reasons or to determine eligibility for subsidies or special tax schemes. These classifications are usually quite arbitrarily decided, e.g. to be in line with the definition of other governments, and do not necessarily have their root in any kind of business logic. Consequently, they often are NOT suitable for the purposes of client segmentation.

Table 1: Classification of micro-, small- and medium-sized enterprises in Uzbekistan

Table 2: Classification of micro-, small- and medium-sized enterprises in the European Union

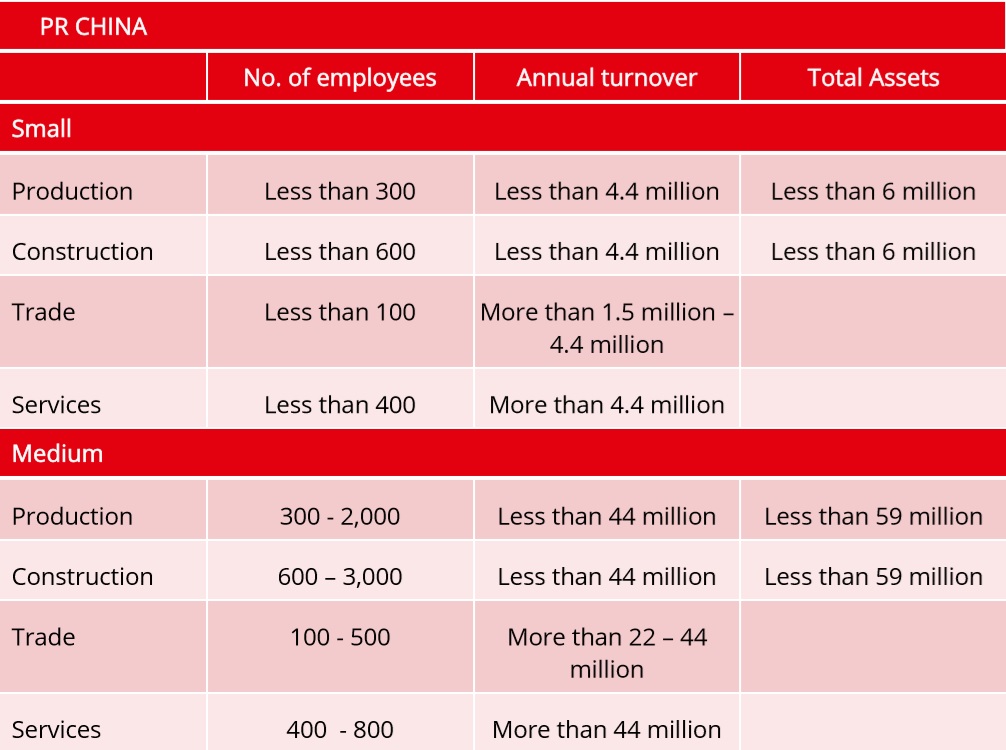

Table 3: Classification of micro-, small- and medium-sized enterprises in the People’s Republic of China

HOWEVER, CAUTION: typical governmental classification approaches may use what look like the same indicators that you would use for segmentation, such as annual turnover, number of employees, total assets, etc. BUT the actual parameters (values) may be different and the context of how indicators and respective values were chosen is fundamentally different!

Getting your segmentation right

How do you know that your segmentation is working and effective? Very simple – you have succeeded in creating homogenous groups, i.e. groups of clients with a similar profile, similar needs, similar behavioural patterns and – as group - distinct from other groups. The approach and methodology you apply to the respective segment is working in that you are reaching the segment as planned, i.e. you are meeting planned business targets at planned resource investment.

Some final notes

Less is more and simple is usually good! The key is using the right indicators and values. While many, especially new business models, often advertise using a myriad of indicators, quantity in itself does not ensure quality.

Homogeneity allows for standardization and automation! The more homogenous a group, its behaviour and needs, the easier it becomes to focus processes, procedures, products, etc. and standardize them. The more standardized a process, etc. is, the easier it also becomes to automate at least parts of this process.

Segmentation itself requires regular review and adjustment! Just as with other aspects of providing financial services, segmenting clients is not a one-time-shot. Clients change, markets change, needs change, technical possibilities change. Against this background it is clear that current segmentation requires regular review and checking to see if the same indicators and values are still relevant. Another aspect of this is to also check on the emergence of new and more meaningful indicators, respectively, to identify possibly obsolete indicators.

Segmentation is part of a bigger whole! Segmentation serves to help you optimize how you operate your business in all its aspects, i.e. how to best set up operations, define personnel needs, processes, procedures, products, technical needs and infrastructure. It is not a goal or purpose in itself.

Disclaimer

This document was published to contribute to and stimulate discussion on topics related to MSME finance or other related relevant topics in Central Asia. The views presented are those of the author/authors of this document, and do not necessarily represent the views of EBRD or contributors and donors of the RSBP for Central Asia. The RSBP for Central Asia does not guarantee the correctness, completeness or quality of the information provided in this document. The RSBP for Central Asia, its contributors and donors do not take any responsibility for any damage caused by the use of the information published in this document.