Acronyms and abbreviations

|

Term |

Explanation |

|

AI |

Artificial Intelligence |

|

AISP |

Account Information Service Provider |

|

AML/CFT |

Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) |

|

API |

Application Programming Interface |

|

B2C, B2B, C2C |

Business to Consumer, Business to Business, Consumer to Consumer |

|

CBS |

Core Banking System |

|

DFA |

Digital Field Application |

|

DFS |

Digital Financial Services |

|

FI |

Financial Institution |

|

MIS |

Management Information System (CBS and other integrated systems) |

|

mPOS |

Mobile POS (Point of Sales) |

|

MNO |

Mobile Network Operator |

|

MSME |

Micro, Small and Medium Entrepreneur |

|

PSD2 |

Payment Service Directive Revised |

|

PSP |

Payment Service Provider |

|

P2P |

Peer to peer |

|

QR code |

Quick Response code, a two-dimensional barcode |

|

VAS |

Value-Added Services |

Executive summary

In this paper the author presents the journey towards digital transformation that financial institutions (FIs) are gradually embarking onto. The aim of this paper is to help demystify this growingly complex technological question, rife with buzzwords and new concepts. The main focus is on what the author deems meaningful and practical for FIs in transition economies, respectively in Central Asia.

The author describes some general trends observed in more mature markets, which are likely to become relevant to developing countries and countries in transition, introduces terminology that is emerging as industry-standard, explains the distinction between digitization and digitalization, and describes the basics of digital transformation. The author provides some examples in order to illustrate main principles, but these examples are by no means meant to express any view or judgement about these cases. Finally, the role of regulators is discussed and an example presented of how Payment Service Directive Revised (PSD2) is affecting European banks.

One key message the author would like to convey is that there is no ‘one-size-fits-all’: local conditions, positioning of FIs, competition, structures of the respective market and – naturally – strategic objectives of the FIs themselves can lead to various rational approaches. At the same time, the author would like to insist that inaction is not an option and we will provide some high-level actionable advice for FI executives.

Digitization, digitalization and digital transformation

Terminology

In this part, we will provide a definition of key concepts, which are often confused or misunderstood, but useful for accompanying you along your digital transformation.

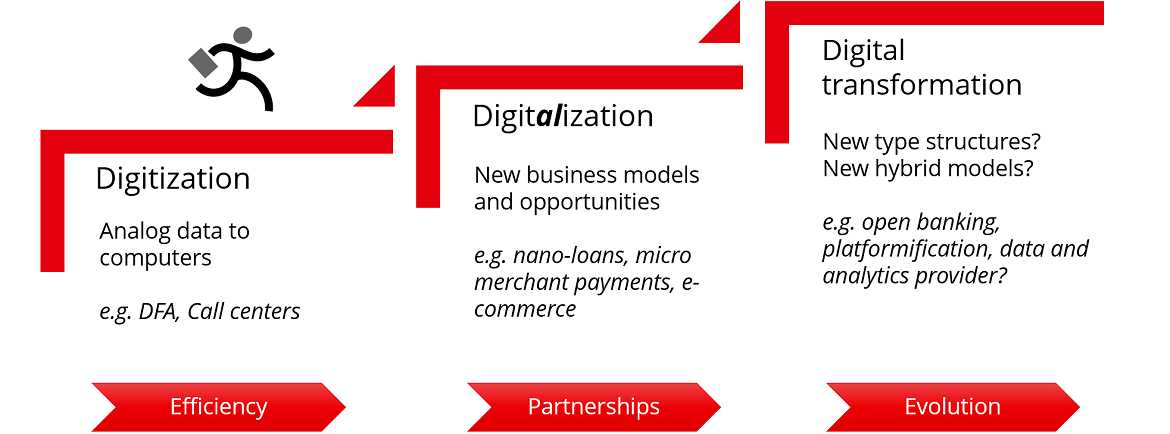

Figure 1: The digital transformation ladder

Digitization

Strictly speaking, digitization means converting information stored in analog formats (i.e., paper, voice, pictures, etc.) into a digital format, so that computers can store, understand and treat this data. Most FIs have been actively digitizing their activities for decades: implementing systems such as core banking system (CBS) or management information system (MIS) to store and automate processing of business information. Some institutions, especially those engaged in microfinance activities, have been working with Digital Field Applications (DFA) for ten years or so. They equip their field staff (loan officers or customer relationship officers) with tablets or smartphones, enabling collection of information in digital form while visiting customers and potential customers at their premises. This permits to progressively phase out paper-based forms, ensure better quality of data and faster business operations (e.g. credit underwriting/decision making).

Major outcomes are the lowering of loan turn-around-time and overall improvement of portfolio quality due to a more systematic and optimized collection, processing and analysis of customer business data. Once collected, customer data is treated by the system and presents insights for the credit committee/loan decision maker. If a credit-scoring model is also digitized, loans can be fully automatically assessed and disbursed. Digitization is also achieved through the spread of mobile and internet banking, which reduces the brick-and-mortar presence of FIs and, at the same time, allows FIs to deepen the digital footprint of customers.

The concept of big data1 has been widely discussed in recent years. While some aspects are relevant and promising, far too often FIs are tempted to leapfrog and plunge (and invest) into it without having first established sound data management and a sound data strategy. We would notably advise to first:

- Ensure solid data management, put into place through a dedicated business person or group in charge of defining and implementing data policy and strategy within the institution;

- Prepare and maintain a data inventory: which data does the FI have available? Where is it located (in which system(s))? And, more importantly, which data is required and not yet available (or at least not yet digitized)? And, lastly, lay out a strategy to acquire needed data;

- Control data quality: overcome problems due to data redundancy and its corollary: inconsistency;

- Make sure data is cleaned up, compiled in a meaningful manner and can be accessible to business executives in a practical way (via tools such as business intelligence, analytical reporting systems, etc.).

Digitization is a first necessary and important step along the journey. It is also a never-ending story: when new products or services are developed, all too often, decision-makers fail to think “digital” and create new paper-based forms. It requires a lean approach to ensure the constant reduction of “hard” information.

Digitalization

Digitalization refers to providing financial services via digital channels. This can be achieved by FIs on their own or as partnerships between FIs and other firms. The following examples draw on Digital Financial Services (DFS) associated with e-commerce providers and payment services providers (PSP). Among other widespread cases, one can also list partnerships involving a mobile wallet provided by Mobile Network Operators (MNOs).

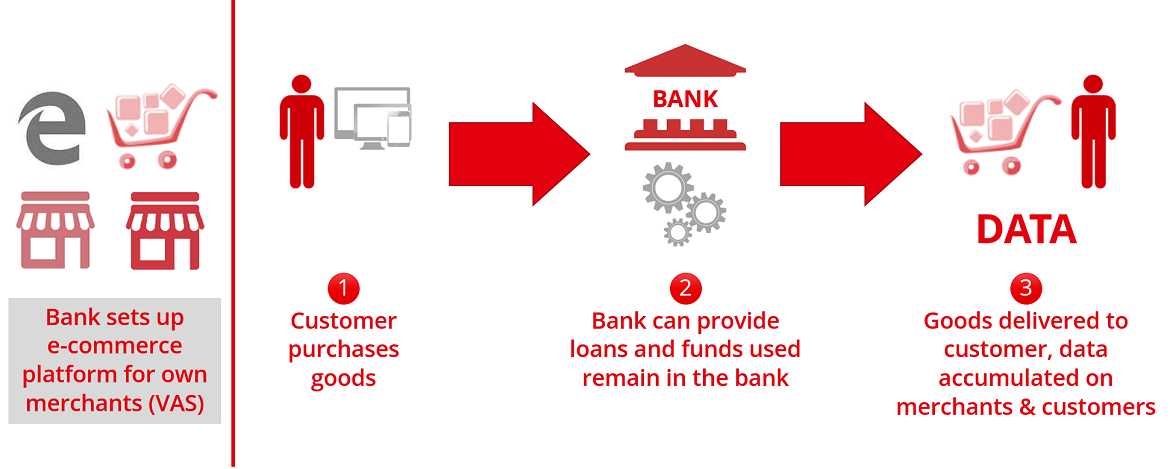

Case 1: FI-led e-commerce platform

Figure 2: e-commerce platform created by a FI

This case is about a bank dominating retail operations in a fairly mature market. In order to promote interaction between its individual customers and its micro-, small- and medium sized enterprise (MSME) customers, the bank offers its MSME customers the possibility of setting up an e-shop (a value-added service for MSME customers) and accepting digital payments (e.g. by cards) when selling their goods and services to, for example, individual customers. Individual customers can also shop at these MSMEs using a consumer loan streamlined to the online sales process and thus expanding the volume of the bank’s activity.

There are also secondary advantages to this type of scheme:

- The funds remain within the institution (when a sale is performed, the money goes from the individual customer account to that of the MSME customer – both held at the bank);

- The FI gathers more information about its customers (for individuals, it collects consumption-related patterns. At the same time, the same information can also be used to understand sales turnovers of MSME customers better).

Business to consumer (B2C) is not the only model for e-commerce: other cases could involve a business to business (B2B) market place for suppliers of micro business customers (e.g. a platform where wholesale suppliers of inputs sell to small farmer customers of the bank) or even a consumer to consumer (C2C) model fostering intra-individual customer transactions, such as small-scale sales similar to those through classified ads. We can think of P2P platforms where some sales and purchases of goods between individuals could be organized by an FI that would supply financial services to facilitate such transactions (e.g. credit or digital payment services).

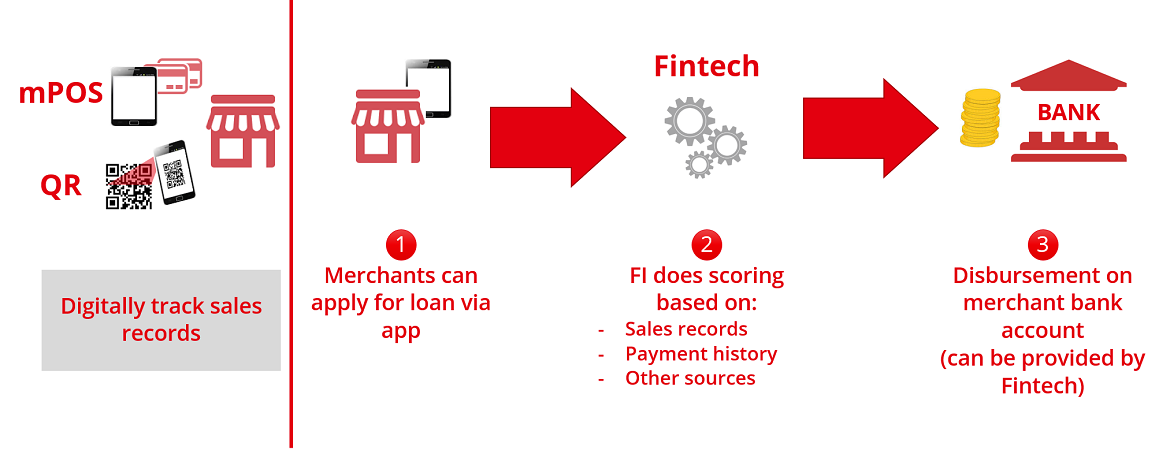

Case 2: Digital payment platform

Figure 3: Financial ecosystem around a payment service provider (PSP)

In markets of various maturity some Fintech payment service providers (PSP) are providing digital payment services to MSMEs, either by cards (notably using mPos) or by other means such as quick response codes (QR codes) or social network-based transfers. In the past, many MSMEs usually only accepted cash payments and were often unable to provide a reliable track record of their sales history, necessary to establish the credit-worthiness of their activity. Thanks to these digitized transactions offered by PSPs, MSMEs are now able to substantiate their business activity levels and have become eligible for loans provided by PSPs or partnering FIs.

Some fintechs have been able to obtain other information about MSMEs from other sources as well, such as sales history from global online B2C market place platforms or shipping service companies. Fintechs can also provide MSMEs access to other value-added services, such as online simple stock and accounting management solutions, based on the use of which these fintechs can further analyze MSME business performance. In case these MSMEs do not have bank accounts, the banks collaborating with the respective fintech can acquire these clients for account opening and even issuance of debit or credit cards.

Digital Financial Services (DFS) provided by FIs and fintechs

Digital financial services (DFS) can be provided by either fintechs or traditional FIs. There is always room for collaboration and the lines between fintechs and FIs tend to blur. For example, while this is still exceptional, some major fintech firms in the USA are now applying for banking licenses. Fintechs progressively cover the spectrum of financial services provided by traditional actors. At the same time, we see some FIs gradually investing in e-commerce platforms or working more closely with fintechs to supply these fintechs with services only FIs can provide. A recent survey by PricewaterhouseCoopers (PwC) identified that roughly 80% of large FIs are seriously considering investing in fintechs and that they expect a return on investment of close to 20% over these efforts.2

Another important takeaway is to understand that data itself is sought after. Data is no longer just a means to an end but an end per se, and end in itself.

Digital transformation

Digital transformation is a longer-term evolution of the nature and business – in our case - of FIs. This phenomenon will radically change how banks operate, what their business lines look like and how the will interact with the whole financial ecosystem. Within the next 5 to 10 years, most FIs will have to transform, to open their systems and learn how to cooperate with other sorts of (hybrid) firms, fintechs and others. One obvious and already existing novelty is ‘open banking3’: FIs provide their existing infrastructure and systems “as a service” to different types of non-regulated companies (e-commerce portals, PSPs, insurance companies, cryptocurrency exchanges, remittance service providers, etc.). Most of this type of cooperation will be with fintechs.

Let us now look at how fintechs and FIs can cooperate or compete.

Fintechs: friend or foe?

What are fintechs?

Fintechs are financial technologies companies using high and new technology which are providing financial services and competing or cooperating with FIs. Overall, they are more agile than traditional FIs and invest more in technology aimed at addressing one particular question, for example providing loans to farmers using artificial intelligence (AI) or alternative sources of data.

Fintechs are more agile in the sense that they typically are smaller firms, capable of rolling out new products or changes faster and with less effort than a – typically – larger FI. The fact that fintechs typically are trying to solve one specific question also makes them more prompt to adaptation. In terms of use of high technology, surveys have found that some 46% of large fintechs have invested in AI while only roughly 30% of large banks have.4

|

Fintechs |

Traditional FIs |

|

Agile |

Bureaucratic |

|

Horizontal culture |

Vertical culture |

|

High-tech (e.g. AI) |

Low-tech (legacy CBS…) |

|

Highly specialized |

Broader spectrum of clients |

|

Light regulation |

Heavy regulation |

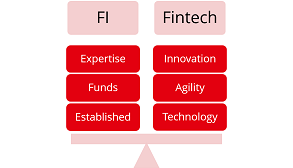

Figure 4: Comparative advantages of Fintechs over traditional FIs

Are FIs now irrelevant?

“Banking is necessary, banks are not” (Bill Gates, 1994). For some time, it was a widespread view that classic FIs, foremost banks, would become obsolete. However, banks are still here 25 years later. In recent years, it has become clear that fintechs have limitations as well and that banks still can bring a lot to the table. Notably, banks/traditional FIs have the following strengths that are valuable in partnerships:

- Large existing customer base and associated data;

- Cheaper access to capital;

- Existing risk management procedures and systems dealing with AML/CFT;

- Infrastructure (branches, information systems, ecosystem connected to PSPs, etc.);

- Expertise about markets in which they operate;

- Licenses, i.e. they are regulated which gives some comfort/lowers some risks;

- Credibility and visibility (brand name).

Fintechs cannot easily compete on the points above and do not necessarily want to do so. The last thing most fintechs would want, especially newcomers, is to set up a heavy CBS or obtain a banking license: they would rather collaborate with FIs endowed with such assets and benefit from the existing infrastructure etc. to sell their services.

Figure 5: Best of both worlds

In the next part, we will share some insights about the European experience and demonstrate how the regulator in the EU pushed for deepened cooperation between FIs and fintechs.

Regulatory aspect: the European example

Regulatory aspect

A regulator can decide to protect an existing industry, making it harder for newcomers to enter the market. Alternatively, in other cases, a regulator can force some of the existing players to share information with newcomers in order to make it easier for newcomers to become established and to promote competition among players. In recent years, we can observe this trend in Europe, as the regulator is pushing for further integration of the EU market.

What is PSD2?

The Payment Service Directive Revised or ‘PSD2’, issued in 2016 and coming into force in 2018, is a new regulation affecting some 9 000 banks in 29 European markets. It is aimed at further unifying the banking sector of the European Union and at enhancing competition among banks (and other institutions engaged in this field) in Europe.

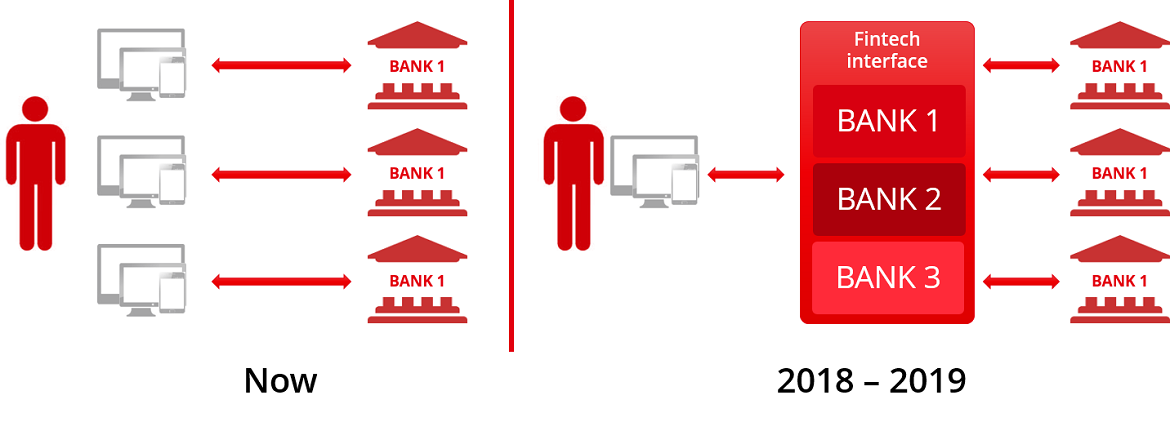

Without delving into details, one of the main consequences of PSD2 is the appearance of Account Information Service Providers (AISP). Existing FIs and new players (typically fintechs) will have the possibility to register as AISP and then - with the consent of the account holder - to fetch lists and details of operations performed on a given account in an automated manner. This will allow individual account owners holding accounts at several banks and possibly in several countries, to share their information with an account aggregator. One of the major implications is that individuals may then not only use their own accounts, their own banks’ internet or mobile banking services for transactions, but those of third parties as well. This will increase competition between banks, banks and fintechs, and is expected to be reflected in improvements in quality of service and lower costs for users of financial services in Europe.

Figure 6: Impact of PSD2 in terms of account information aggregation for online and mobile banking

An example of services that could be built upon this evolution could be an artificial intelligence-powered bot providing financial advice to customers on where best to invest their funds based on the combined information about the customer across several banks. This naturally could also be applicable to credit as well. Financial services may not only be delivered by traditional FIs (including those holding accounts of the customer) but also by third-party financial service providers such as dedicated Fintechs.

Risks and opportunities

In the case of Europe, it is expected that traditional banks will have a hard time retaining their current customers. Especially millennials are more likely to migrate their accounts to new players (e.g. especially to institutions with accessible and user-friendly online and mobile banking platforms).

PSD2 is a critical game changer and traditional FIs are now seeking partnerships in order to stand out from the crowd and remain in the race. The most advanced FIs have already started opening their systems and offering “bank-as-a-service” type of new business products so that fintechs can “piggyback” onto existing systems of FIs and offer their services to the established clientele of such FIs. Open banking and platformification5 of banks are unlikely to be just a trend: they reflect a long-term evolution of the industry.

Those institutions dragging their feet will suffer while those embracing these changes have opportunities for reaping the benefits of their efforts across the European market. Naturally, this will entail significant investment in information systems so that FIs can open their systems to third-party players. We can also expect an increase in cyber-criminality and information theft.

While Europe is a specific case, it would be surprising if similar regulation would not also appear in other parts of the world in coming years.

Conclusion

FIs will face numerous challenges on their digital journey and technology-related issues are not necessarily the thorniest. IT system and data management are going to play a strategic part at organizations. The entire approach to business may be expected to be impacted and FIs need to rethink their business in principle. Foremost this concerns how to acquire, engage and retain customers. Brick-and-mortar branches are going to be phased out and relationships with customers will be conducted increasingly via digital channels. Risk and audit departments will also be affected by automation and the deployment of DFS. Against this background, human resources management is gaining in importance and HR departments are becoming of key importance in terms of ensuring that institutions are staffed with competent labor at the right time as well as in terms of supporting – where possible - transition of existing employees to the digital world.

While there is sequential graduation from digitization to digitalization and digital transformation, all these steps remain relevant and it is easy for FIs to slip back into old habits and reinstate some paper forms as existing MIS may not always be able to evolve as quickly as the creativity of bankers. New channels are likely to be used to provide existing products - some in partnerships, others using channels fully controlled by FIs. This is a logical evolution of business. However, developing new business lines based on platformification or monetization of advanced data analytics (i.e. selling data) provided by FIs to third-party firms is a totally new paradigm and – at least at this time - few are likely to have the capacity for picking up this gauntlet.

Therefore, we would like to share some advice with FI managers as concluding remarks to this document:

- Doing nothing is not an option: while FIs will still exist in the next five or ten years, their role and nature will change; you cannot just simply wait & see;

- Handle and access your data in a better way: develop a data strategy and ensure that some business executives are entrusted with ensuring its implementation;

- Start looking around for partnerships: you can already identify which fintechs are operating in your market and try to partner with them. Likely, the best way to learn is by doing. This will allow you to gain a better understanding of the new challenges to be faced and investments required for such endeavors;

- Promote an innovative culture within your institution: it is easier said than done, but there are strategies to promote innovative culture, such as organization of hackathons, removing silos – creating trans-department working groups, and fostering a corporate culture that is more horizontal.

More than technology itself, your human resources and their freedom to try & fail will position your institution ahead of others in this race to innovation.

1 Big data is usually described as a large volume of data, both structured and unstructured, that comes from a variety of sources, and aims at providing a business with better insights. While big data can be useful to refine some models, most FIs should first aim at collecting and managing “good data”, i.e. data that is meaningful, consistent and up-to-date. This is already a challenge per se, that few FIs, even in mature markets, are capable of addressing in a systematic manner. Big data is on the longer-term horizon but should be kept in mind.

2 PwC. Redrawing the lines: FinTech’s growing influence on Financial Services. What does FinTech mean for financial services organizations: innovation, disruption, opportunity - or all of them? Join the conversation: #FinTech. https://www.pwc.com/gx/en/industries/financial-services/fintech-survey/report.html

3 Open banking refers to banks providing access to their systems via open APIs – that is an API documented and usable by anyone (depending on accessibility policies).

4 Ibid, PwC. Redrawing the lines: FinTech’s growing influence on Financial Services

5 Platformification refers to a business model whereby banks sell the use of their systems and infrastructures “as a service” to 3rd-party firms (typically fintechs). For example, if an online lender wants to offer a credit product to the clientele of a bank, this online lender could do this by plugging its own system into that of the bank. The bank would provide services related to infrastructure, providing existing clientele, risk management etc. and earn commission on money lent by this online lender.